Each move that your institution makes leaves a digital trace. Though this footprint makes them fast and scalable and customer-focused and innovative, it also presents unseen weaknesses that can gradually accumulate. This means that Understanding Digital Risk Profiles for Saudi Financial Institutions is no longer a compliance box. It has become a strategic need in ensuring the protection of trust, quickening transformation, and enhancing resilience in operations in the fast-growing financial sector in the Kingdom.

The changes in cyber threats are also dynamic, and the banks and fintechs should not be dependent on old evaluations or generic models. They should instead assess their risk exposure in a more precise way, make decisions that reflect the expectations of the regulatory body, and take the initiative to mitigate the chances of disruption.

Why Understanding Digital Risk Profiles for Saudi Financial Institutions Matters More Than Ever

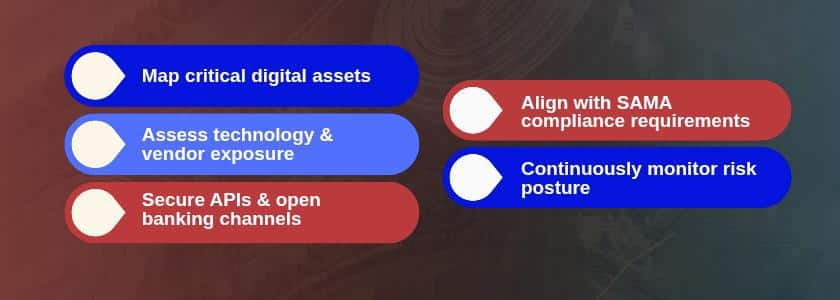

Though financial organizations in the Kingdom have made a grave step towards enhancing cybersecurity, the threat environment keeps changing drastically. The knowledge of Digital Risk Profiles of Saudi Financial Institutions is even more essential in the sense that the attackers are more likely to target high-value digital assets, such as payment systems, customer data streams, API ecosystems, and cloud-native infrastructures. In addition, with stricter regulations by SAMA and new national cybersecurity frameworks, fragmented visibility and reactive protection are unaffordable for institutions.

Additionally, the process of digital transformation encourages banks to implement new technologies more rapidly. This renders the number of potential points of attack by the attacker quite substantial. This means that every new integration, vendor relationship, mobile channel, or automated workflow will have to be evaluated intensively in order to have a secure and compliant environment. With a clear ideofon of their risk profile, institutions become more resilient and reduce the risk of service outages, fraud, or regulatory fines.

Key Components of a Digital Risk Profile in the Saudi Financial Landscape

Though the digital risk profiles differ among organizations, they always involve a number of major components. Although all of these components have an effect on the overall posture, the real difficulty lies in the ability to bind them together in a manner that is representative of risk exposure in the real world. The factors that influence these profiles in the changing Saudi Arabian financial landscape are listed below.

1. Complexity of the stack of technology

The growing bankerification of the core system, the use of cloud systems, and AIs in the solutions used by banks make the technological environment of banks increasingly sophisticated. Due to the complexity, which may create misconfigurations and blind spots, the institutions need to continuously re-examine the interactions of the systems, data flow, and dependencies. Moreover, old systems that coexist with new architectures are a major contributor to risk since they reduce visibility and automation.

2. Third-Party and Vendor Ecosystems

The Saudi financial institutions are becoming more dependent on third-party fintechs, cloud providers, analytics partners, and digital service vendors. Even though these alliances boost innovation, they bring in outside risks that the institutions have no direct control over. As such, they need to embrace effective third-party risk management practices such as round-the-clock monitoring, security of contract, and independent audits.

3. Open Banking/API Based Services

Massive innovation has been opened by the movement towards open banking in Saudi Arabia. However, APIs establish novel attack vectors because they are accessible and connected. As a result, the institutions are to protect the authentication flows, verify access permissions, and provide constant control over abnormal behavior.

4. Regulatory Compliance Requirements

The financial regulating bodies in Saudi Arabia, especially SAMA, have stringent standards of cybersecurity and risk control. Compliance frameworks offer guidelines, but the institutions need to interpret them into an operation-based control. The inability to align digital services to these requirements might lead to punishments, the limitation of services, or the critical loss of reputation.

How Institutions Can Strengthen Their Digital Risk Profiles

Even though the digital risk profiles differ. The way towards their enhancement is known to take a set of strategic steps. The trick is to make these steps coincide with the internal processes and business objectives. Since each institution functions differently.

1. Develop an effective real-time Risk Inventory

Due to the rapid change of risks, financial institutions require a more recent and consolidated perspective of their online resources, information flows, integration points, and risk exposure. The discovery tools can be automated to assist in mapping the environment and uncovering concealed vulnerabilities.

2. Embrace Continuous Risk Monitoring

The static tests are no longer realistic with the real-life threats. Rather, the institutions ought to employ continuous monitoring that identifies any alterations in risk posture immediately they happen. This would entail technology investments, but the long-term gains greatly surpass the expenditure.

3. Enhance Governance and Accountability

Digital property taken into clear ownership will result in a quick response and eliminate confusion in operations. Consequently, the governance structures should identify the ownership of every risk, the remediator, and the decision-escalation procedure.

Saudi-Specific Challenges That Shape Digital Risk Profiles

Despite the similarity in the problems of global institutions, the financial sector of Saudi Arabia works in different conditions. Digital Risk Profiles of Saudi Financial Institutions should take into consideration such complexities locally.

To begin with, the rates of digitization in the Kingdom are increasing at an even higher rate. It is just a remnant of the Vision 2030 objectives. This means that financial institutions will need to adapt to the ever-changing technology without compromising security. Also, the regulating bodies pay specific attention to the industry. This implies that institutions must maintain compliance even as regulators modify the frameworks.

Second, there is a significant shift in customer expectations. The Saudi users require high-speed, mobile-first, seamless experiences, and this places a strain on the institutions to implement digital solutions as quickly as possible. Even though one can achieve rapid deployment, this approach increases the risk of misconfiguration gaps and undiscovered dependencies.

Conclusion

Understanding Digital Risk Profiles of Saudi Financial Institutions will enable organisations to manoeuvre around dynamic threats with a sense of security. Due to the dynamic nature of digital ecosystems, institutions have to evaluate and implement their risk posture with accuracy. Resilience through good governance and constant monitoring minimizes operational loss.

Also, harmonization between cybersecurity and business objectives makes it possible to achieve secure innovation and regulatory preparedness. Finally, financial organizations that focus on transparent risk exposure maintain confidence and speed up the digitalization of the long term.

Frequently Asked Questions

1. Why are digital risk profiles essential for Saudi financial institutions?

They ensure that vulnerabilities, gaps in compliance dependencies of operations are seen clearly. Besides, they can direct institutions to make informed choices that enhance security and resilience.

2. How often should institutions update their digital risk profiles?

They should be updated constantly by institutions, particularly when there have been significant shifts in the system, the addition of new integrations, changes in regulations, or the deployment of cloud-based services.

3. Does understanding digital risk profiles reduce compliance challenges?

Yes. Clarity of the profile facilitates compliance by matching controls with the regulatory requirements, reducing the audit issues, and minimizing the chances of penalties.