The issue of cyber threats is constantly changing, and hence the organisations should select security strategies that will safeguard their revenue, reputation, and operations. Most leaders are no longer taking MDR vs SOC technically, but as a business case. MDR vs SOC desire better payoff, results, and lower organizational risk.

Although the two models are both supposed to protect against cyberattacks, they vary greatly regarding cost structure, scaling, expertise, and operational efficiency. Therefore, your decision has an impact on the speed of threat recognition in your company, the performance of teams, and how confidently the administration prepares to grow.

This guide can assist you in knowing the business worth of every approach, making you invest smartly and safeguard what holds the greatest importance.

Understanding the Core Difference Between MDR vs SOC

Security Operations Center (SOC) is an internal security service that your internal staff will be overseeing the systems, investigating alerts, and handling threats. Firms tend to establish SOCs to ensure security operations are in their direct control.

Managed Detection and Response (MDR), in its turn, offers outsourced threat monitoring and response that is offered by professional cybersecurity companies. Organizations utilize external skills and professional technology in real-time, instead of developing them in-house.

Even though both models reinforce security positioning, they have varying financial and operating effects. Thus, leaders should consider them in terms of business value in the long run instead of preference in infrastructure.

Evaluating ROI and Where Your Money Works Harder

Most executives make decisions based on return on investment. Security expenditure should demonstrate an ability, rather than a technical capacity.

Soc requires a massive initial investment. The co-owners have to employ analysts, buy tools, sustain the infrastructure, and train employees all the time. In addition, the lack of security talents raises salaries annually. Consequently, operations usually cost more than projected.

On the other hand, MDR changes expenditure to a predictable subscription scheme. Businesses do not spend colossal amounts of capital, but only on results like detection and response to threats. Also, the providers distribute the cost of technology to many clients, and this enhances affordability.

Business Outcomes That Leadership Actually Measures

Continuity, productivity, and revenue protection are the topics that executives usually focus on, while security teams prioritize alerts and vulnerabilities. A customized SOC comes with an internal SOC, and teams establish workflows based on business activities, modifying monitoring according to organizational priorities. As a result, firms gain better visibility into proprietary systems, which improves MDR vs SOC ROI.

Nonetheless, tailor-making takes time. Most SOC teams take months to perfect processes to achieve maximum efficiency. During that ramp-up period, organizations face elevated exposure to risk, which can affect MDR vs SOC ROI if not managed carefully.

MDR providers usually implement tested frameworks as soon as possible. They recognize attack patterns quickly because they monitor threats across the industry. Moreover, they automate response activities to minimize disruption, helping organizations strengthen MDR vs SOC ROI while maintaining business continuity.

Scalability and Future Readiness

Growth brings complexity. The attack surface is growing fast with new locations, adoption of clouds, and remote work. An expansion of a SOC would entail new employees, expanded spaces, and more equipment. Thus, growth in expansion does not follow business growth.

MDR adapts more fluidly. The coverage offered by the providers is dynamic and can follow the changes in the environment, which means that security can keep up with the transformation.

Threat intelligence supports future preparation. Attack techniques evolve quickly, and organizations must stay informed. MDR companies analyze data sets all over the world, which enhances predictive defense. Those companies that choose to take risks rather than respond to it are more effective in preserving the value of shareholders.

Compliance and Financial Protection

Regulatory penalties can destroy organizations. Therefore, active security favors financial stability. SOC teams have direct compliance workflow oversight, an advantage in highly regulated industries. Nevertheless, it takes constant work to be audit-ready.

Many MDR providers integrate compliance reporting into their services. Automation of documentation eases the audits and gives stakeholders confidence.

Besides, cyber insurance companies are also becoming more rigorous in determining detection capability before extending cover. Good surveillance enhances insurability and could lower the premiums. Security investment, therefore, supports a broader financial strategy.

When Each Model Makes Strategic Sense

Select a SOC when there is a strong need to customize your organization, when the organization is on a large scale, and when there is the budget to support the long-term investment. This route is preferred by enterprises that have unique infrastructure.

Choose MDR in case you require fast maturity, foreseeable expenses, and professional coverage without developing all that internally. This strategy is often applied by mid-sized firms and fast-growing companies.

Notably, there are those organizations that use hybrid strategies. They maintain a lean internal governance team and use external experts in monitoring.

The correct choice will match security with business direction and not technicality.

Making the Decision with Confidence

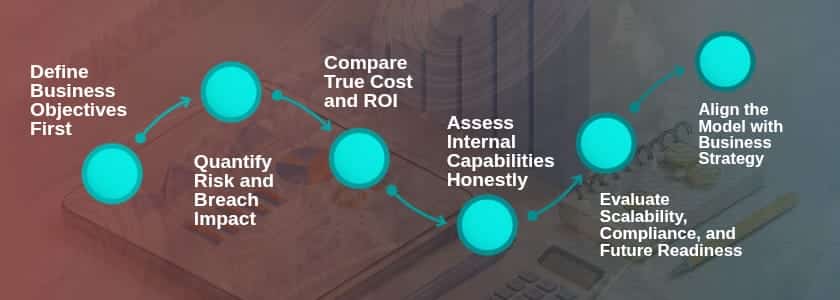

The first step that the leaders should take is to establish key goals. Want to have predictability in the costs? Faster response? Stronger resilience?

The second step is to determine possible impacts of a breach and operational costs. Priorities are explained by numbers. Then, calculate internal capabilities fairly. Excessive anticipation of being ready is a blind street.

Lastly, account securityiss a business enabler. The protection must not hinder the innovation, but rather hasten it. Companies can invest confidently and improve competitive positioning when they make decisions regarding security based on quantifiable results.

Conclusion

The success of businesses is now influenced by the security strategy just as market strategy is. Businesses that consider security based on ROI, effect on capacity, and reduction of risks invest wisely.

The two models are both useful, but the differences in the benefits are based on organizational maturity and growth strategies. The internal centers offer control, whereas the managed services offer speed and efficiency.

At the end of the day, the most powerful one will secure the income, retain the loyalty of the customers, and promote the business in the long run. Leaders who make cybersecurity consistent with business objectives develop sustainable resilience. Select the model that is just as hard-working as your business.

Frequently Asked Questions

1. Which option typically delivers faster ROI?

MDR tends to provide quicker ROI since organizations do not have to spend a lot of money and can get into the expertise right at the beginning. But mature SOC environments can be of value to large enterprises over the long term.

2. Does outsourcing security reduce control?

Not necessarily. Powerful providers are those that provide transparent reporting, joint working processes, and personalizable policies. Thus, strategic control of companies is ensured, and daily functions are carried out by specialists.

3. Can organizations switch models later?

Yes. Most companies change their strategy as they develop. Others move on towards MDR to SOC, and others choose the hybrid model of internal governance with outside scrutiny.